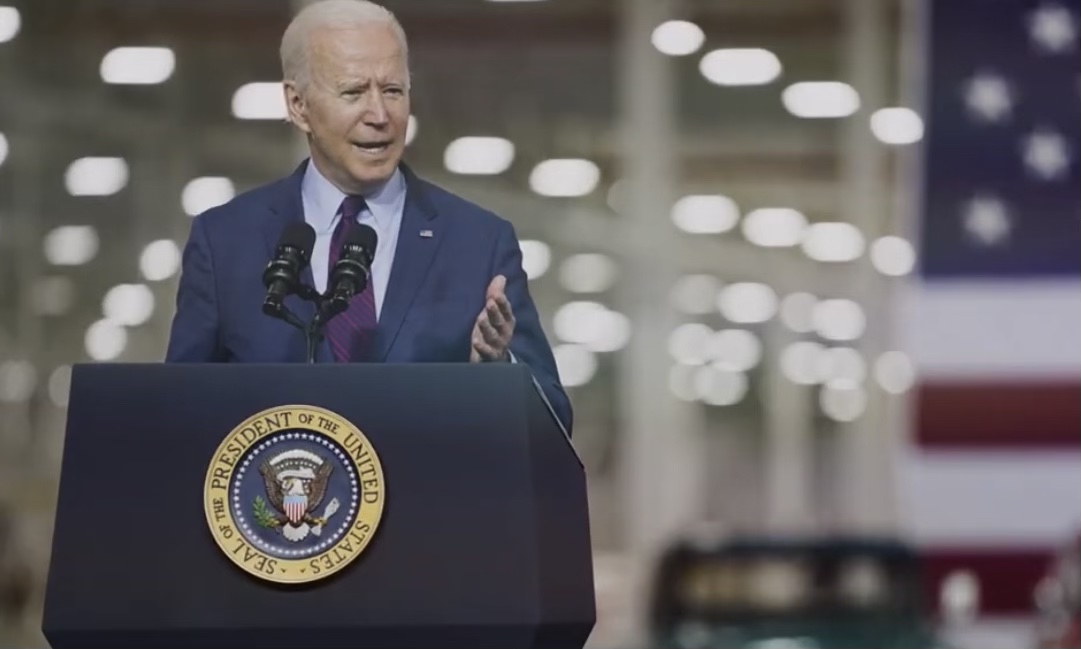

On Tax Day, President Biden’s Tax Fairness Agenda Centers Hardworking Americans

FOR IMMEDIATE RELEASE: April 15, 2024

PRESS CONTACT: [email protected]

ON TAX DAY, PRESIDENT BIDEN’S TAX FAIRNESS AGENDA CENTERS HARDWORKING AMERICANS

The Biden-Harris Administration Continues to Build our Economy from the Middle Out and the Bottom Up, Clamp Down on Wealthy Tax Cheats, and Protect Social Security and Medicare

WASHINGTON, DC – On Tax Day, tens of millions of families will once again pay their fair share of taxes by filing with the IRS, while the wealthiest Americans and big corporations will continue to benefit from 2017’s MAGA tax cuts. Since taking office, the Biden-Harris Administration has continued the fight to make the ultra-wealthy and big corporations pay what they owe — including in the president’s FY 2025 budget proposal — all while cutting taxes for working and middle class families.

“President Biden, Vice President Harris, and Democrats in Congress have worked in lockstep since day one of this Administration to ensure that hard working families across the country see the benefits of the generational investments we have made in our economy — all without raising taxes a single penny on anyone making less than $400,000 a year,” said Building Back Together Executive Director Mayra Macías. “At the same time as they are creating investments in our economy that will benefit working families for generations, the Biden-Harris Administration has continued to slash taxes for working families and cut the national debt by over $3 trillion. Here at Building Back Together, we’re proud to have a president whose administration is looking out for hard working Americans — rather than trying to benefit wealthy tax cheats and big corporations.”

President Biden’s plans stand in strong contrast to the Republican Study Committee’s recent MAGA budget proposal, which cuts federal funding for Medicaid, the Children’s Health Insurance Plan, and the Affordable Care Act by over half; raises the age of eligibility for Social Security and cuts program benefits by $1.5 trillion, impacting over 65 million Americans; and passing $5.5 trillion in tax cuts to benefit America’s wealthiest individuals and corporations. The RSC’s MAGA budget will also encourage companies to take advantage of hard working Americans by eliminating the Consumer Finance Protection Bureau, kill millions of jobs created by the Biden-Harris Administration’s investments in America’s clean energy economy, and end President Biden’s successful caps on the cost of insulin for seniors by repealing much of the Inflation Reduction Act.

###